Clearing Confusion on Temp Buydowns & Loans Assumptions

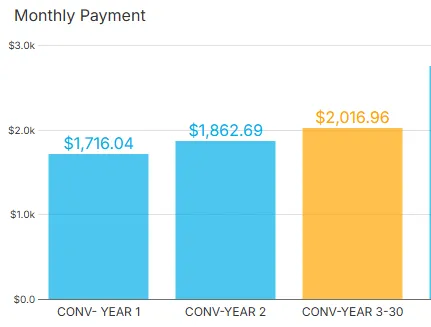

Temporary Buy Downs

Temporary buy downs remain a great tool to make homeownership more manageable for clients. Here are a few points to clarify:

Funding Sources: While these are often funded via seller concessions, they don’t have to be entirely seller-paid. Funding can also come from a combination of:

Seller concessions

Realtor rebates

Lender credits

Borrower contributions (if needed)

Buyer Contributions: While buyers can fund a portion of the buy down account, it’s typically not advisable since it’s essentially setting aside their own money to subsidize payments. But it is important to know that they can as it can help if they need to contribute a small amount to fully fund the temporary buydown account.

If you need a refresher and deeper dive on temp buydowns overall, reach out!

Loan Assumptions

Loan assumptions are another frequent topic of discussion, and it’s important to understand the specifics:

Conventional Loans:

Not assumable in most cases.

The only exception is in scenarios like a divorce, where one party takes over the loan.

Sub-to financing (where buyers "take over" payments without lender approval) is not a true assumption. The lender could call the loan due if discovered, leaving the borrower at risk. The borrower’s credit remains at risk as well as they are never taken off the NOTE.

FHA & VA Loans:

Fully assumable, but with conditions.

VA Loans:

Can be assumed even by non-veterans (doesn’t need to be a primary residence).

Can be assumed by investors

FHA Loans:

Must be a primary residence for the new buyer.

All assumptions are handled by the current servicer of the loan.

Office Hours:

Monday to Friday

9:00 am to 9:00 pm

Email: [email protected]

Call 720-939-4849

Office: 1120 W. 122nd Ave, Suite 103

Westminster, CO 80234